|

|

|

|

SigmaBleyzer: Macroeconomic Situation in Ukraine

|

|

| |

18 September 2012

18 September 2012

• Further deterioration in the external environment hit the Ukrainian economy in June: industrial production fell by 1.4%

yoy and exports dropped by 11.3% yoy in US Dollar terms.

• Robust domestic consumption and acceleration in agriculture supported real sector performance in June.

• Consumer prices fell for the third month in a row in July.

• The National Bank of Ukraine continued to support a strong Hryvnia peg to the US Dollar through sizable foreign

exchange interventions and maintaining tight banking liquidity.

• Tight liquidity led to a notable increase in the cost of borrowing for the private sector, further undermining credit growth.

• Due to a wider current account deficit and larger external debt repayments, Ukraine’s BoPs switched to a $1.5 billion

deficit in June, but may turn into a surplus by next month thanks to a $2 billion sovereign Eurobonds placement.

• Ukraine reported a 40% yoy lower state budget deficit in 1H 2012 thanks to strong budget revenue growth and control

over non-social expenditures. At the same time, public finances will remain under pressure in the short-term, requiring

solid fiscal consolidation measures after the elections.

Executive Summary

According to early State Statistics Committee of Ukraine

estimates, real GDP growth accelerated to 3% yoy in 2Q 2012,

up from 2% yoy in the previous quarter. The acceleration

may be attributed to stronger private consumption, an

earlier harvesting campaign and co-hosting of the Euro-

2012 football championship. Thus, loose fiscal policy and

record low inflation underpinned a 16.5% yoy increase in

real wages in 2Q 2012 compared to about 14.7% yoy in 1Q

2012. Thanks to strong real wage growth and the European

football tournament held in June, retail sales picked up by

16% yoy over January-June 2012, while output production in

food processing maintained growth momentum, advancing

by 3% yoy in June.

Agriculture production, which was up by 28% yoy in June

compared with 2.5% yoy a month before, helped offset

weaker construction and industrial sector performance. With

the completion of infrastructure upgrade projects related to

the Euro-2012 football championship, construction declined

by almost 9% yoy in June 2012. Renewed Eurozone sovereign

debt woes and slowing world economic growth weighed

on world commodity prices, which fell sharply in June. In

addition, domestic lending remains sluggish, constraining

economic activity. As a result, Ukraine’s industrial production

declined by 1.4% yoy in June on weaker performance of

export-oriented and capital intensive industries. Thus,

the chemical industry lost steam, expanding by about 6%

yoy in June from almost 15% yoy a month before. Output

in metallurgy, machine building and manufacturing of

construction materials fell by about 1% yoy, 9% yoy and 5%

yoy in June, respectively. Although robust domestic demand

will continue to support economic growth through the rest of

the year, due to a more subdued global growth outlook in 2H

2012 and sluggish domestic credit growth than we initially

expected, real GDP growth is forecast at around 2% yoy in

2012.

Ukraine witnessed a drop in its consumer prices in July, for the

third consecutive month. In annual terms, however, the index

fell by 0.1% in July compared to 1.2% the previous month.

Slower decline may be attributed to an easing favorable

statistical base impact on food prices and increases in

railway transportation and phone service tariffs. Considering

price developments from January to July 2012, our year-end inflation forecast was adjusted downwards to 6% yoy.

May-July 2012 showed that within the NBU’s complex policy

mix of stimulating anemic credit growth and maintaining

the Hryvnia exchange rate peg to the US Dollar, the latter

target has prevalence over the former. To contain currency

movements in July, the NBU continued to intervene in the

foreign exchange market by selling almost $1.2 billion of

its international reserves on a net basis and keeping banking

sector liquidity tight. Liquidity constraints and high credit

risks pressured credit rates upwards and affected credit

availability for the real sector. The stock of bank credit grew

by only 3.8% yoy in June and was only 0.1% higher since the

beginning of the year.

The Balance of Payments switched to a $1.5 billion deficit in

June amid higher external debt repayments and a worsened

current account. While a deficit on the financial account was

anticipated, the deterioration in the current account balance

was sharper than expected. Weaker overseas demand and

falling world commodity prices caused deep declines in

exports of metals, chemicals and mineral products, which

together accounts for more than half of Ukraine’s exports.

Although agricultural exports kept growing at a solid pace,

total export of goods fell by 11% yoy in US Dollar terms in

June compared to a 9.6% yoy increase the previous month. A

financial account balance is expected to turn into a surplus by

July thanks to successful issuance of $2 billion of sovereign

Eurobonds. Despite a favorable near-term outlook, Ukraine’s

BoPs will remain under pressure in the short and medium

term due to high external financing needs amid a challenging

external environment.

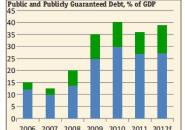

At the beginning of 2Q 2012, Ukraine amended its state budget

law to implement generous social spending increases. Unlike

expectations, compensatory measures, such as a wealth tax,

were not introduced. However, robust revenue growth and

control over ‘non-social’ expenditures helped keep the state

budget deficit 40% lower in 1H 2012 than in the respective

period last year. Near-term fiscal financing needs have eased

thanks to robust privatization receipts, a $2 billion Eurobond

issuance and a VTB loan rollover. However, public finances

are likely to remain strained in the short-term as the annual

state budget revenue target looks overly optimistic, given

slower economic growth and inflation than projected by the government, reliance on NBU profit transfers to the budget, and

expected acceleration in expenditures through the end of the year. A notable increase in state budget guarantees at the end of

July adds to fiscal sustainability concerns. Hence, solid fiscal consolidation measures will be needed to ease these concerns

after the elections.

Source: USUBC

|

![]() |